How to Replace Your Chase Debit Card

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

Need to replace your Chase debit card? Here's how to request a new one through the website, mobile app or customer service.

- How to Replace Chase Debit Card Online

- How to Replace Chase Debit Card Via Mobile App

- How to Replace Chase Debit Card Over the Phone

- Other Ways to Pay

J.P Morgan Chase Bank is one of the biggest banks in the U.S. They're known for their personal banking and credit card products. Take a look at how to replace your debit or credit card below.

How to Replace Chase Debit Card Online

Follow the following steps to request a new Chase debit card online:

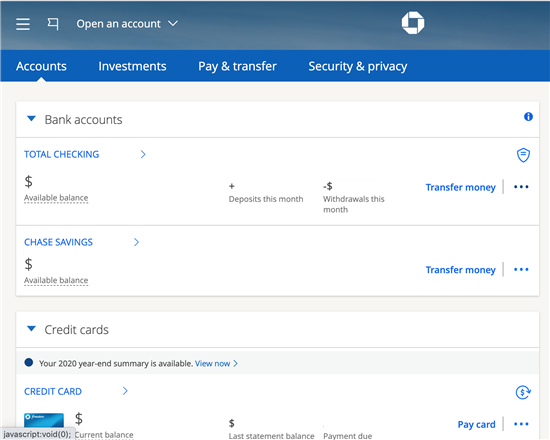

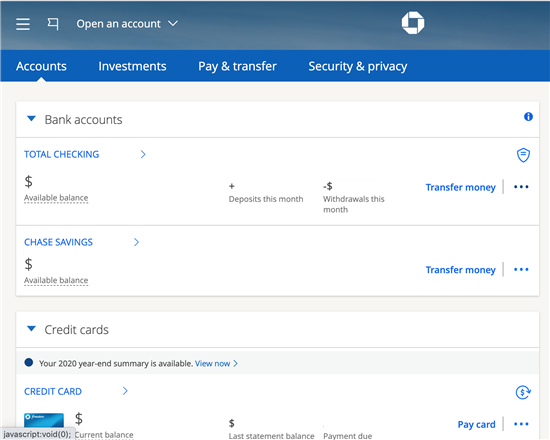

|

| Screenshot of Chase |

- Login to Chase.com

- Go to your checking account

- Select "More…" on top right hand side

- Select the dropdown "Account Services"

- Go to "Replace a lost or damaged card"

- Choose your card and include a reason for replacement

- Review and submit your request

- You should receive a response within 1 business day.

When will my Chase card arrive?

You'll receive your Chase debit card within 3-5 business days. If you don't receive your card within two weeks, you can request a replacement card online.

How to Replace Chase Debit Card Via Mobile App

- Sign into your Chase Mobile app

- Select your checking account for a debit card

- Scroll to find "Replace a lost or damaged card"

- Choose your card and include a reason for replacement

- Review and submit your request

- You should receive a response within 1 business day

How to Replace Chase Debit Card Over the Phone

- Call Chase Card Services at 1-800-432-3117 (available 24/7)

- Enter the last four digits of your card number OR ask to speak to a representative

- A live person will assist you. Next, confirm your identity and mailing address for where your new card will be sent.

Other Ways to Pay

- Chase Mobile app for money transfers or deposits.

- Write checks to pay bills and make other payments.

- Chase Pay (mobile wallet app similar to Apple Pay or Google Pay) for some places

Conclusion

It's pretty quick and easy to replace your Chase debit or credit card. Just call Chase Card Services, or log into Chase.com or the mobile app. If you want to make financial transactions while waiting for the replacement card, access your account online or via the mobile app. You'll receive a debit card for Chase's checking accounts. To earn a bonus, consider applying for one of their Chase coupon codes.

Member FDIC

Chase Total Checking® - $300 Bonus

Expires 10/16/2024

- New Chase checking customers enjoy a $300 bonus when you open a Chase Total Checking ® account with qualifying activities

- With over 4,700 branches, Chase has the largest branch network in the U.S. plus access to more than 15,000 ATMs.

- Chase Mobile ® app - Manage your accounts, deposit checks, transfer money and more -- all from your device.

- JPMorgan Chase Bank, N.A. Member FDIC

- Open your account online now

- Available online nationwide except in Alaska, Hawaii and Puerto Rico. For branch locations, visit locator.chase.com.

- Chase Overdraft Assist℠ - no overdraft fees if you're overdrawn by $50 or less at the end of the business day or if you're overdrawn by more than $50 and bring your account balance to overdrawn by $50 or less at the end of the next business day*

Member FDIC

Bank of America Advantage Banking - $200 Bonus Offer

Expires 9/30/2024

- The $200 bonus offer is an online only offer and must be opened through the Bank of America promotional page.

- The offer is for new checking customers only.

- Offer expires 9/30/2024.

- To qualify, open a new eligible Bank of America Advantage Banking account through the promotional page and set up and receive qualifying direct deposits totaling $2,000 or more into that new eligible account within 90 days of account opening. Bank of America Advantage SafeBalance Banking® for Family Banking accounts are not eligible for this offer.

- Once all requirements are met, Bank of America will attempt to pay bonus within 60 days.

- Additional terms and conditions apply. See offer page for more details.

- Bank of America, N.A. Member FDIC.

Member FDIC

Discover® Online Savings - $200 Cash Bonus

Expires in 4 days

To qualify for Bonus: Apply for your first Discover Online Savings Account, enter Offer Code CY624 at application, deposit into your Account a total of at least $15,000 to earn a $150 Bonus or deposit a total of at least $25,000 to earn a $200 Bonus. Qualifying deposit(s) may consist of multiple deposits and must post to Account within 45 days of account open date. Maximum bonus eligibility is $200. What to know: Offer not valid for existing or prior Discover savings customers, including co-branded, or affinity accounts. Eligibility is based on primary account owner. Account must be open when bonus is credited. Bonus will be credited to the account within 60 days of the account qualifying for the bonus. Bonus is subject to tax reporting. Offer ends 09/12/2024, 11:59 PM ET. Offer may be modified or withdrawn without notice. See advertiser website for full details.

Member FDIC

CIT Bank Platinum Savings - 4.85% APY

- 4.85% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

Free Business Checking - Up to 2.0% APY

- 2.0% APY on your balance up to $250,000 for customers that meet monthly eligibility requirements

- $0 minimum opening deposit

- $0 monthly service fee

Amber Kong is a content specialist at CreditDonkey, a bank comparison and reviews website. Write to Amber Kong at amber.kong@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts. Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

How to Text Chase Bank for Your Balance

What Do I Need to Get a Chase Credit Card

Chase Routing Number

- Chase vs Bank of America

- Chase vs US Bank

- Chase vs Fifth Third Bank

- Chase vs Discover Bank

Chase Credit Card Promotions

CreditDonkey Staff

I cover the intersection of money, career, and entrepreneurship

Chase Total Checking® with

Platinum Savings with (minimum balance of $5K required)

Free Business Checking with up to

Free Checking Account for Small Business Owners

No-Fee Business Checking with

Advantage Banking with . Member FDIC

Online Savings Account with

- Chase First Banking Review

- Chase Reviews

- Chase Private Client Bonus

- Chase Bank Open Account

- Chase Investment Account Bonus

- Chase Business Checking Bonus

- Chase Business Checking Requirements

- How to Open a Chase Business Bank Account

- Chase Business Complete Banking Review

- Chase Business Checking Fees

About CreditDonkey

CreditDonkey is a bank comparison website. We publish data-driven analysis to help you save money & make savvy decisions.

Editorial Note: Any opinions, analyses, reviews or recommendations expressed on this page are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

†Advertiser Disclosure: Many of the offers that appear on this site are from companies from which CreditDonkey receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). CreditDonkey does not include all companies or all offers that may be available in the marketplace.

*See the card issuer's online application for details about terms and conditions. Reasonable efforts are made to maintain accurate information. However, all information is presented without warranty. When you click on the "Apply Now" button you can review the terms and conditions on the card issuer's website.

CreditDonkey does not know your individual circumstances and provides information for general educational purposes only. CreditDonkey is not a substitute for, and should not be used as, professional legal, credit or financial advice. You should consult your own professional advisors for such advice.

(888) 483-4925 | 680 East Colorado Blvd, 2nd Floor | Pasadena, CA 91101

© 2024 CreditDonkey Inc. All Rights Reserved.